B-ANGULAR Business Controlling: Home - bangular

592-pte

In this story, we’ll tell you quick facts to know, such as what causes a bad wheel bearing, how long you can drive on one, and the estimated replacement cost of a wheel bearing as you maintain your vehicle.

Editor’s Note: This article has been updated for accuracy since it was originally published. Rick Kranz contributed to this report.

Kelley Blue Book® Values and pricing are based in part on transactions in your area. Your ZIP code also helps us find local deals and highlight other available offers.

Driving with bad wheel bearings impacts the safety of a vehicle, and it could cause a serious car accident. We do not advise driving on them when they fail and recommend getting them checked out as soon as possible. Bad wheel bearings can damage things like your hub, the vehicle’s constant velocity joint (CV joint), or the automatic transmission.

Key insights from tax advisors reveal essential takeaways regarding Form 592 B. Many experts emphasize the importance of ongoing training to keep preparers updated with new regulations and best practices. Enhanced knowledge leads to reduced risks of errors, promoting smoother filing processes.

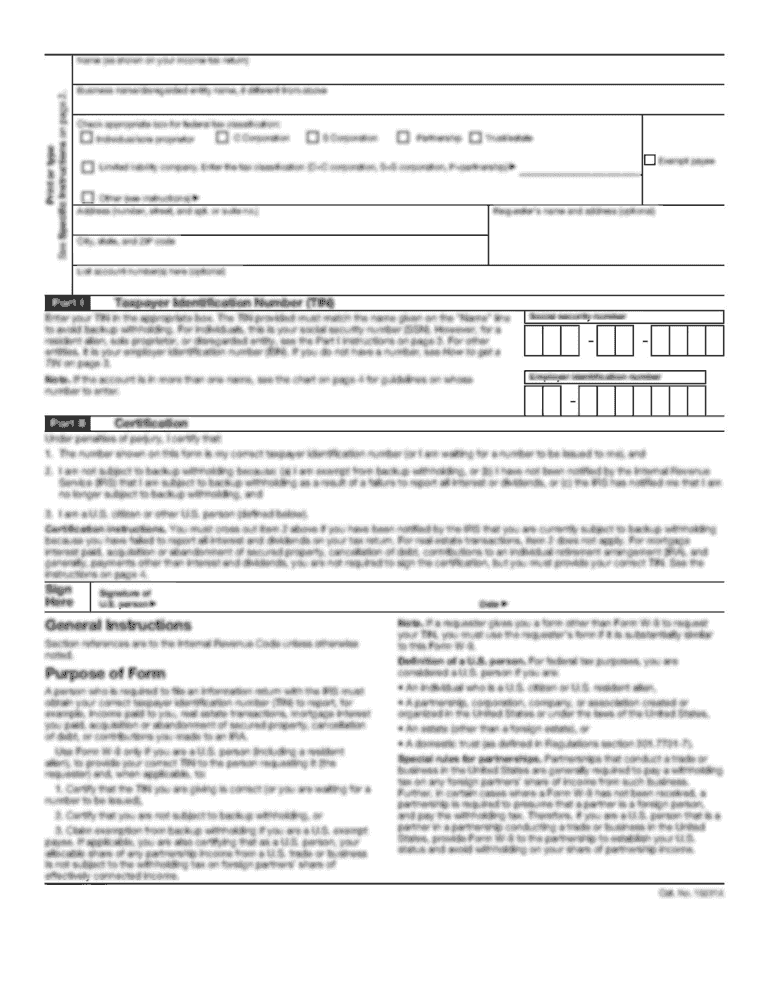

Decoding the terminology associated with Form 592 B can be crucial for both preparers and filers. Understanding terms such as TIN, source income, and backup withholding is key to complying with California tax law. Each box on the form is designed to capture specific information, and knowing what is required will guide preparers through the process smoothly.

If you hear a clicking sound that increases in frequency as the vehicle accelerates, there could be a problem with the wheel hub assembly.

To enhance document management and filing processes, leveraging technology is crucial. Various digital solutions exist to simplify the filing of Form 592 B. Adopting effective software can automate calculations and assist with data entry to ensure compliance.

Payees must navigate payment types thoroughly, as Form 592 B can apply to several different income streams. This encompasses everything from interest payments to rental income. Understanding and categorizing these payments correctly will help ensure compliance and minimize risks associated with wrong categorization that could lead to legal repercussions.

The bearings are tightly packed in a grease-filled, waterproof, sealed metal ring. This housing, called a race, is located inside the hub, and each wheel has one. Wheel bearings have a Herculean responsibility: They are engineered to support the vehicle’s entire weight.

State-level tax regulations demand that anyone engaging in business with non-residents be familiar with their withholding obligations. Form 592 B is significant in this regard as it streamlines the reporting process. Failing to comply with these requirements can lead to penalties, emphasizing the need for meticulous attention to detail. Payers must grasp why this form matters and how it impacts their overall tax strategy.

Find out what our economists say about car prices dropping. We share the best and most updated information so you can make an informed car-buying decision.

The most easily identifiable and common symptom of bad wheel bearings is audible. But it can be confusing. For example, the source of a humming noise can be linked to other issues, such as tires and the CV joint.

Additionally, Form 592 B has significant implications for Pass-Through Entities (PTE) filing situations. PTEs must be particularly diligent about their compliance due to the structure of their income and the resulting obligations for withholding taxes. There are strategic differences when dealing with resident versus non-resident payees that affect your filing approach.

Kelley Blue Book® Values and pricing are based in part on transactions in your area. Your ZIP code also helps us find local deals and highlight other available offers.

If one tire wears out faster than the others, it could be a sign that the wheel bearings are worn. However, it also could be a sign the tire is improperly inflated (too much air pressure or not enough), the tires are improperly aligned, or the vehicle has damaged or worn suspension components.

Utilizing these resources effectively will help maintain compliance and streamline the overall filing process. By focusing on both structure and strategy, taxpayers can confidently navigate the complexities surrounding Form 592 B.

The typical sounds of worn-out wheel bearings are squealing and/or growling. The sound intensifies as vehicle speed increases. Try to pinpoint the location of the noise because it will identify the location of the worn-out bearings.

Identifying source income accurately is foundational to fulfilling tax obligations under Form 592 B. Various types of income, from wages to dividends, fall under taxable categories. Understanding these distinctions ensures that preparers comply with tax requirements directly related to the nature of the income received. Importantly, source income dictates the withholding amounts that must be remitted to the state.

Creating a personalized compliance checklist can also serve as a practical guide for individual and corporate filers alike. This checklist should include essential steps and can be customized based on unique tax situations, ensuring that all requirements are met.

Learn all about E85 in our guide, what cars use it and availability of this biofuel. Find out what flex-fuel offers plus the advantages and disadvantages.

The cost to replace one front-wheel hub assembly varies widely. Among the variables are the vehicle brand and model, the garage’s labor rate, and the cost of parts. The average out-the-door wheel bearing replacement cost without taxes is about $350 per wheel.

The anti-lock warning light may illuminate if the ring, tire, and wheel wobble, the wheel’s speed sensor is no longer operating properly, and the ABS may operate sporadically or not at all. See a professional for repair.

592-b 2024

Navigating through Form 592 B can appear daunting, but with a clear understanding of its structure, the filing process becomes manageable. The form consists of several sections, each serving a distinct purpose. For instance, the identification section requires tax identification numbers (TIN) and details of the payments made. Each box within the form is purposeful, and completing it correctly can significantly reduce compliance issues.

Adopting best practices can significantly mitigate issues. Prepares should implement checklists to ensure completeness. The filing process also involves understanding deadlines for submission to avoid fines and penalties. Familiarizing oneself with the different options available for filing, whether digitally or through paper forms, will enhance efficiency and ensure compliance.

Form592instructions

If there is excessive play in the steering, meaning the steering seems less responsive or less precise than normal, worn bearings could be causing the problem. Also, this could be a sign the vehicle needs a wheel alignment. If you have any of the signs listed above, visit a dealer service or auto repair shop.

Integrating Form 592 B considerations into broader financial strategies creates a proactive climate for managing tax obligations. By considering possible revisions and changes, taxpayers can plan their strategies to adapt seamlessly.

Wheel bearings connect a car’s wheels to the axles. They allow wheels to turn with minimal friction. Though wheel bearings are low-maintenance parts, they are important safety components of a vehicle’s braking, steering, and suspension systems. The one-piece hub assembly, between the drive axle and the brake disc or drums, incorporates the hub, wheel bearings, ABS (anti-lock braking system) wheel speed sensor, and mounting flange.

Form592

In another instance, a small business effectively handled withholding requirements with the help of proper guidance and documentation. This approach showcased the importance of having clear processes in place, emphasizing the benefits of staying informed about current tax regulations.

Hardesty cautions that if you think something is wrong, don’t wait to get it diagnosed: “The longer you wait, the more it will cost as other components may be damaged by a wheel bearing.”

Wheel bearings are theoretically engineered to last the life of the vehicle. There is no maintenance schedule for replacing wheel bearings, and there is no constant source of lubrication. However, they can be damaged, leading to failure.

Most vehicles today use sealed hub bearing assemblies that contain roller bearings. While we don’t address these, older cars used tapered roller bearings, which required servicing and preload adjusting to ensure the right amount of end play or axial clearance.

Your vehicle will signal that it’s time to replace a failed wheel bearing. For example, if you hear unusual sounds like humming or clicking, then your bearing might be bad. Watch out and listen for these signs and symptoms:

2024 Form592

Filing accurately means paying attention to every section of Form 592 B, from basic identifying information to specifics regarding income sources. Misplacing a decimal point or omitting essential information can lead to substantial delays or penalties. Clear communication with payees is vital to ensure that the information entered is accurate and complete.

592-b vs 592-pte

The California Tax Form 592 B is essential for compliance with state tax regulations, particularly when it comes to withholding taxes from non-residents. This form provides an organized way for payers to report and remit taxes on payments made to non-residents who earn income in California. Understanding the nuances of how Form 592 B functions is critical, especially for businesses and individuals engaged in transactions that involve payees outside their resident jurisdiction.

© 1995-2025 Kelley Blue Book Co.®, Inc. All rights reserved. Copyrights & Trademarks | Vehicle Photos © Evox Images | Terms of Service | Privacy Policy | Linking Policy | Accessibility Statement | Manage Cookies

Bad wheel bearings can cause the steering wheel to vibrate. The intensity increases as the vehicle speed increases and the vehicle turns to the left or right. However, the vibration could be linked to an out-of-round tire (there could be a flat spot on the tire) or a tire that is no longer balanced. Another cause is damaged or worn suspension components.

Group returns can be a strategic advantage for managing multiple payees under Form 592 B. This mechanism allows businesses or individuals to consolidate multiple payments on a single filing, making it easier to manage tax obligations across a group of taxpayers. Recognizing what a group return entails can alleviate the administrative burden while improving accuracy.

592 binstructions

Tax professionals also suggest strategies to navigate the complexities of the form itself. Consistency in training and staying informed about the most recent updates can support more efficient filing and boost compliance rates among payers.

The preparer's role in managing Withholding tax compliance is vital. They not only ensure that forms are accurately filled out but also that all regulations are adhered to. Preparing Form 592 B requires attention to detail and a keen eye for potential pitfalls. Common mistakes include misclassification of income sources and failing to secure necessary approvals from the payee.

These stories illustrate common challenges faced within the landscape of Form 592 B compliance. Learning from real experiences can guide others toward successful pathways, revealing the importance of preventative action when preparing tax documentation.

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

The original equipment bearings on your vehicle are engineered for specific loads. Those bigger and wider tires look cool, as do tires with lower tread walls. But they place higher loads on the wheel bearings, possibly resulting in accelerated wear. That could present a safety issue if your wheel bearings fail.

As regulations evolve, staying updated with changes to Form 592 B is vital for compliance. Anticipating these changes can ensure that taxpayers are always one step ahead, reducing the risk of non-compliance penalties. Emerging trends in state tax regulations often hint at areas likely to be revised, and proactive engagement with these trends will instill confidence in the filing process.

However, luxury cars are more expensive to repair. Do note that if bearings go bad at one wheel, replacing the bearings at the other wheel on the same axle is unnecessary. Don’t let someone talk you into work that is not needed. Get the price estimate for wheel bearing replacement for your make and model of car.

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Imagine driving on the freeway when the left front tire and wheel suddenly break off, sending your out-of-control vehicle skidding across several lanes of 65 mph traffic. This is not an exaggeration. This is reality, and can happen if you fail to notice the signs the wheel bearings are deteriorating and need immediate repairs. Your wheel bearing might be bad if you hear unusual sounds like humming, squeaking, or clicking. Some experts say a bad wheel bearing can sound like a bird chirping. Also, if your car wobbles or pulls to one side, you will want to get it checked.

“The good news is most of the time, a vehicle will let you know way before a failure ever happens,” said Gary Hardesty, Kelley Blue Book’s in-house service and maintenance expert and an A.S.E. certified master technician. “The key is to listen to your car. Most times, a failing wheel bearing will exhibit a growling type of noise that changes with vehicle speed. The faster the car (goes), the faster the frequency of the growl.”

Navigating the implications of PTE filings enhances compliance. Exploring the dynamics of income flow for PTEs is essential for tax strategy, ensuring seamless reporting and reduced risk of penalties.

form 592-v

Utilizing Form 592 B as a tool for strategic planning can help avoid unnecessary complications in tax filing and withholding processes. Successful navigation of upcoming regulations will greatly impact financial strategies for businesses and individuals alike.

Examining success stories can provide valuable insights into the practical application of Form 592 B. One case study focused on a corporate entity highlighted their seamless filing process. By prioritizing accuracy and communication, they achieved successful compliance without issue.

Withholding tax is a critical component of the California tax landscape. It acts as a prepayment of tax obligations, ensuring taxes are paid as income is earned. Through Form 592 B, payers can declare their withholding actions, accurately reflecting payment amounts that require withholding. Understanding the fundamental principles of withholding tax assists everyone in the transaction comply with local laws.

Technicians can check for wheel wobble by putting the vehicle on a lift and manually checking for wheel movement. Typically, it would be impossible to shake the wheel and tire. However, if it moves, the hub assembly needs immediate attention. The tire and wheel can literally come off the vehicle at any time, at any speed, if you don’t repair your vehicle.

Worn bearings may cause a vehicle to pull to the left or right when brakes are applied. The direction the vehicle pulls signals where the worn bearings are located, on the left or right side of the vehicle. However, this can also signal brake rotor or brake caliper problems.

Maintaining clear communication with all parties involved is essential to the success of group returns. This may include reminding payees to supply their tax identification numbers or other pertinent information that affects compliance. Developing a standardized system will help ease the process for all involved.

Timely submission of Form 592 B is essential. Understanding when and how to submit ensures that payers are compliant year-round. Distinguishing between digital filing and paper submissions can also streamline the process, with digital methods often proving faster and more efficient.

Leveraging technology can enhance the management of group returns. Prepares can utilize software designed to simplify the consolidation of information from various payees. This approach also minimizes the risk of error, as it ensures a consistent review process when gathering data.

Key components of Form 592 B include details about both the payer and the payee. Proper preparation relies on gathering all necessary information from both parties to ensure accurate filing. Know your key players as you navigate the form: the payer is responsible for withholding, and the payee is the recipient of income that may be taxed. Understanding these roles is crucial for effective compliance.

Accurate payment reporting is critical. With precise data, prepaid taxes are more likely to mirror actual obligations, allowing both payers and payees to maintain compliance with minimal stress.

These insights underscore the necessity for preparers to cultivate a culture of continuous learning, not only in handling Form 592 B but also in grasping broader tax compliance frameworks.

8613869596835

8613869596835